How do you payoff debt? How do you break free from the chains of debt that’s growing at an alarming rate? What is the average debt, the types of debt and the generations in debt? Get rid of those chains of debt and payoff debt fast. The goal is to be totally debt free. You don’t want to owe anyone anything. And you don’t want debt to control you.

U.S. Debt Statistics

Below are key statistics of the U.S. debt that shows we have a huge problem.

The 2020 U.S. national debt was $27.7 trillion while 2019 was $23.2 trillion, a $4.5 trillion increase according to the U.S. Department of Treasury. The current debt is over $28 trillion and counting according to the real time U.S. debt clock. The U.S. national debt measures how much the government owes its creditors.

The 2020 U.S. consumer debt is almost $15 trillion. This is an $800B+ increase than 2019. Since 2010, consumer debt has increased by 31% according to Experian.

Break Down by Debt Type and Generation

Now let’s break it down by debt type and also what generations have debt.

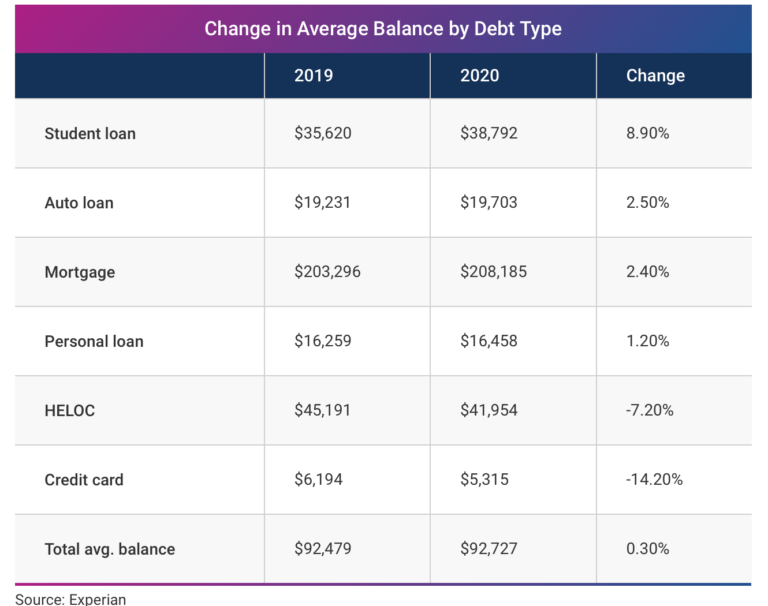

As you can see the 3 highest % increase in debt type were student loans, mortgage, and personal loans. There were declines in retail credit card and Home Equity Line of Credit (HELOC) of almost (11%), and credit cards of (9%).

Due to the nation’s stay-at-home order, there was little to no travel, shopping, eating at restaurants for a period of time. Consumers started spending differently and as a result, less credit card and retail credit card spend. An Experian survey showed 66% of consumers were spending the same or less during the pandemic than they did last year. In addition, one-third of consumers surveyed said they put more in savings in 2020 than they did last year. However, the survey showed that 59% of consumers lost their job or had wages reduced due to the pandemic which meant it reduced their ability to save.

However a Pew Research Center Study shows that Americans are facing financial difficulties and in some cases have taken on new debt to pay everyday living expenses. One in four adults had problems paying their bills especially among those with lower incomes, without a college degree, and Black and Hispanic Americans.

Reasons for Change

Student loans increase may be attributed to the pandemic pause in federal student loan repayment. The mortgage debt increase may be due to the housing market boom with historically low interest rates. Personal loans were one of the fastest growing in 2019 but slowed it’s growth in 2020. It’s expected this will continue to increase as the economy bounces back. A notable reduction was credit card debt, as it’s the first time in eight years that credit card debt didn’t increase. This appears to be due to the pandemic and may continue it’s trend upward as economy returns.

Average Consumer Balance (By Type and By Generation)

While overall debt has increased there was very little change from 2019 to 2020 average consumer balance, $92,479 and $92,727 respectively. If we look at the average consumer balance by debt type, we see a notable decline in credit card balance (14%). Student loans had the largest increase of almost 9%.

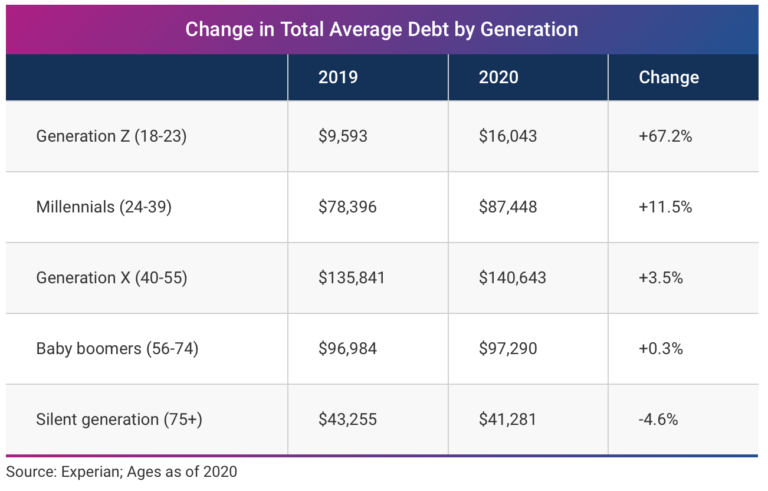

Looking at average debt by generation, it’s interesting to note the younger generation had significant increases in debt. Generation Z had the largest increase of 67% with 2020 average debt of $16,000, while Millennials increased by 11.5% with 2020 average debt of $87,000. The oldest generation had a reduction in debt of almost 5% with average debt of $41,000.

5 Tips and Tools to Be Debt Free

Here are five tips and tools to break free from the control of debt.

#1 – Take inventory of your debt. Write all your debt down.

What’s your debt balance, monthly payments, and interest charges

#2 – Determine which debt to payoff first.

If you have a lot of credit cards, you may want to consider consolidating or doing a personal loan with less interest rate. Also, if you have a good credit score, consider transferring debt to a 0% interest rate credit card. Transfer the highest interest rate cards to the 0% credit card. This will save you from paying interest monthly. If you do this, make sure you pay the minimum monthly amount on time, and do not purchase anything on that card. Then focus paying down the higher interest rate debts. Remember, the purpose is to pay off debt as quick as possible.

#3 – Track actual spend monthly to determine what amount you can live on.

This is where discipline comes in. Determine what is a NEED vs a WANT expense. This is how you will be able to spend less and have more cash to pay down debt. You can track it manually using track spending sheet or use any online budgeting tool/spend tracker.

#4 – Any surplus cash above your monthly spend, invest or save and/or pay down debt.

What you decide to do here really depends on the individual’s financial situation. If your debt has high interest rates, you may consider paying down more debt than saving. The goal is to keep more money coming in than going out via interest expense. If you don’t have a surplus, consider other streams of income or other ways to earn extra money.

#5 – Do a budget and know your budget.

You should have a budget that estimates your cash coming in and going out each month and yearly. If you have done a budget before, for many people it may have changed due to the pandemic and should be revisited. If you have not done one, it’s a great time to do it. It gives you an idea of what you expect to have coming in as cash (net of spend) each month and year.

Bonus Tip: Any extra money you may receive (ie- tax refund, stimulus checks, company bonus, etc.), consider using to pay down your debt. If you can do this consistently, the more you pay down on the debt principal, the faster your debt balance will be lowered. For example, you can pay extra on the mortgage payment and reduce the time of paying it off. Instead of paying off your home in 15 years, you can pay it off in half the time by paying more on the principal. If you make it a goal, budget for this extra payment. You can do it!

Debt Tools and Debt Reduction Goals

You can use financial calculators to help determine when you can payoff a debt in a shorter time by paying more down monthly. There are online financial calculators that can help you determine this. Also, those you have your mortgage with usually has an online debt payoff calculators on their website. Plug in the numbers and see what it would take. Set a personal debt reduction goal.

I personally don’t like debt and rather have cash to put in savings, investments, or own assets. Like I said before, you don’t want to owe anyone anything. If you owe someone, that person owns or controls you. Obtain financial freedom and be debt free. It’s not hard. You just need to start.

The key is to manage your debt and don’t let it manage you. If you need assistance in this area or any of these topics, feel free to contact me below. Sometimes you need someone to guide you through these steps.

To find out your financial health and your money habits, contact me for 1-on-1 sessions and programs offered to teach you about money, spending behaviors, budgeting, tracking your spending. Click the Contact or Take Action button.

Sources:

U.S. Department of the Treasury. “The Debt to the Penny.” https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny. Accessed April 8, 2021.

Experian. “Average US Consumer Debt Reaches New Record in 2020.” https://www.experian.com/blogs/ask-experian/research/consumer-debt-study/#s1. April 6, 2021.

Pew Research. “Economic Fallout from COVID-19 Continues to Hit Lower-Income Americans the Hardest,” https://www.pewresearch.org/social-trends/2020/09/24/economic-fallout-from-covid-19-continues-to-hit-lower-income-americans-the-hardest/. September 24, 2020.