The world has moved closer to being a cashless society. Digital currency is upon us, but will it be central bank digital dollar or cryptocurrency? Paper money is becoming a thing of the past with people opting for electronic transactions. COVID-19 has contributed to the decline of less cash being used. People ordered more products and services online so there would be less physical exchange of paper money.

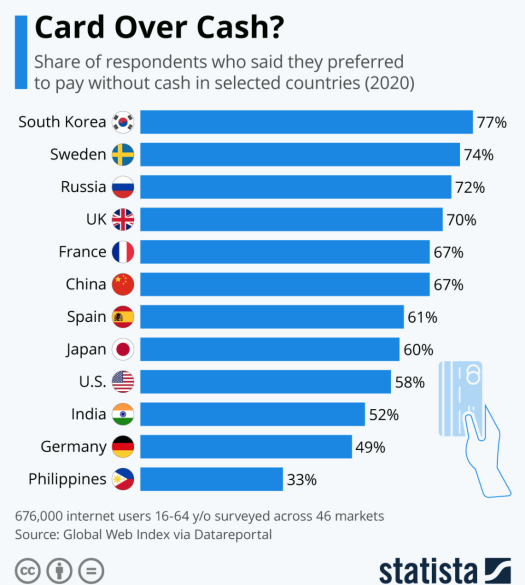

The chart below shows how people from various countries preferred cashless payments. South Korea led the way with 77%, Sweden at 74%, and Russia at 72%. The U.S. is at 58% while China is at 67%. Ten countries are over 50%, meaning they prefer cashless payments. This is a significant increase and it will most likely continue.

This opens the door to adopting a digital currency. Governments are looking to digitize their currencies. The U.S. is the world’s leading reserve currency and if they change to a digital currency, this will have a drastic global financial impact.

Digitized Wallet

Right now, most transactions happen electronically, where people normally make online transactions, purchasing items online via Amazon, Walmart, Target, etc. In the US, about one-tenth of the money supply, U.S. physical currency, is in circulation, while the rest of the money supply is in various banks in electronic form.

WIth digital currency, you wouldn’t be able to make a withdrawal of paper money. All your money would be digital. A digitized wallet would replace a physical wallet. Your digitized wallet can be an app downloaded on your phone. It would be similar to paying with Apple wallet on the iPhone, as it is very convenient than pulling out a credit card. Consumers have gotten used to paying with their phone and using it as their wallet. In the future, there will be other forms of “digital wallets” than the phone.

Many people use payment apps such as Venmo, Cashapp, PayPal, or Apple Pay. For example, if you want to tip the person at the nail salon, you don’t need to withdraw cash from an ATM. You can tip them via Cashapp or Venmo. With technology, ways have been created for convenience for the customer and the business.

Digital Dollar vs Cryptocurrency

Cryptocurrencies are decentralized and can fluctuate wildly in value, such as Bitcoin and Ethereum. For example, Bitcoin, the top cryptocurrency, is not issued or regulated by a central bank. It’s created by a computer generated process via bitcoin mining. It’s a peer-to-peer system and you can make international transactions without exchange fees.

A digital currency issued by the central bank would be different from cryptocurrencies such as bitcoin. The CBDC is a digital currency backed by the central bank and managed by the Federal Reserve. It’s considered to be more stable and less volatile than cryptocurrency as it would be pegged to the US dollar.

The Federal Reserve recently stated, “We’re working proactively to evaluate whether to issue a CBDC and, if so, in what form,” Powell said in a news conference following the conclusion of the U.S. central bank’s latest two-day policy meeting. Powell also stated the Federal Reserve would be releasing a paper on the central bank digital currency.

Cryptocurrency

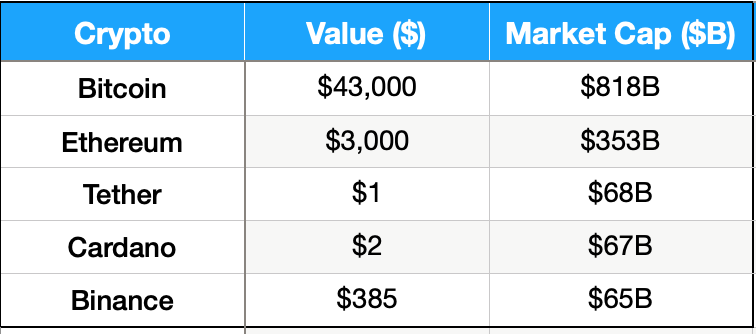

The first cryptocurrency was Bitcoin. It’s based on blockchain technology, decentralized and encrypted. It can be used to buy goods and services. There are more than 12,000 different cryptocurrencies according to CoinMarketCap.com, a market research website. The global crypto market cap is $1.92T as of September 30, 2021. The top five cryptos as of September 30th are listed below along with their approximate dollar value and market cap, which is the total market value of a cryptocurrency’s circulating supply.

Cryptocurrencies are very volatile. In the month of September, Bitcoin was valued at almost $53k on September 6th, and went as low as $41k on September 21st. That’s a $12k swing in value in one month alone. The growth and popularity of cryptocurrencies started with the individual investors, but there are corporations and a country invested in crypto.

Country & Corporations Invest in Bitcoin

Tesla Inc. announced in February 2021 that it invested in $1.5 billion in bitcoin and would accept it as payment for its vehicles. This created a surge in the bitcoin price, however, three months later, Elon reversed course and stopped the purchase of its vehicles with Bitcoin. He tweeted that it was due to the “rapidly increasing use of fossil fuels for Bitcoin mining.” Before Elon Musk decided to buy Bitcoin, other corporations as Microsoft, Paypal, Overstock, Whole Foods, Etsy, Starbucks, Home Depot, and Rakuten accepted payments in Bitcoin.

Not only are large corporations accepting bitcoin, but one country is using bitcoin as legal tender. On September 7th, El Salvador passed a law making Bitcoin an official currency. There are more Salvadorans with bitcoin wallets than regular bank accounts. Three million people have downloaded the Chivo bitcoin wallet, according to the President Nayib Bukele, which makes up about 46% of the population according to Forbes magazine. Chivo converts US dollars into Bitcoin. The government gave all Salvadorans seed money of $30 which was deposited in their Chivo bitcoin wallet. The government expects bitcoin wallet users to continue to rise as they offer other incentives to users of the bitcoin wallet.

CBDC

According to the BIS Survey, around 86% of central banks are exploring a central bank digital currency. Leaders in the blockchain technology discussed regulations and financial inclusion at the Davos Agenda. About 60% are conducting proof of concepts, while 14% are moving forward to pilot program and development, such as Project Helvetia in Switzerland and Turkey. The first to go live with CBDC is the Bahamas with the Sand Dollar, according to the World Economic Forum. The Sand Dollar is the digital version of the Bahamian Dollar and issued by the Central Bank of the Bahamas.

However, the first major country that is close to launching a CBDC nationally is China. China rolled out a digital yuan trial to certain cities. They did this by holding lotteries to hand out digital yuan to residence. $6.2 miilion in digital currency were given to Beijing residence via a lottery in June of this year. China’s digital yuan app is now used by about 140 million people reported by The Block, which includes 9 major cities such as Shenzhen, Beijing, and Shanghai, and is 10% of the population.

Also, China is considering making digital yuan available for foreign athletes and visitors to use during the 2022 Winter Olympics in Beijing. There is no date yet as to when the digital yuan will be the official currency of China, but it’s expected to be the first major CBDC.

What Does Having CBDC Mean?

Let’s take for example China’s digital yuan. It’s backed by China’s central bank, the People’s Bank of China. Since all transactions are now centralized, the central bank and the government will be aware of all transactions, meaning purchases, transfer of monies, domestic and overseas. Essentially, they have access to the who, the what, the when and the where. Using digital yuan as the official currency could deter the use of other digital currencies (i.e.-bitcoin), and provide more control. They would be able to detect if there is money laundering activity with the access to all transactional data.

According the World Economic Forum, the U.S. is working on efforts to create a digital dollar. There are two separate initiatives: The Digital Currency Initiative working with the Federal Reserve Bank of Boston, and the Digital Dollar Foundation working with the consulting firm, Accenture Plc.

In the U.S., which will win? Is it cryptocurrency or Central Bank digital dollar? It’s unclear right now, but what is clear is that we are moving fast and furious towards a digital currency. Whatever digital currency wins, it will certainly change the global financial system.