Investing is for everyone and now there are many avenues to invest your money personally from the comfort of your own home. Investing is important since it can increases your wealth, and you want your money to work for you.

Definition of Investing

Investing is committing (ie-money or capital) to gain a financial return or profit. There is a difference between investing and savings. Savings are money set aside for future use that is liquid and readily available and have little to no risk.

You should have a savings account set aside, and you can open an online savings account that earns an annual percentage yield of 0.50 percent currently. This is better than the national average for savings accounts which is 0.06 percent, according to Bankrate’s June 2, 2021 weekly survey of institutions. However, 0.50 percent is not enough to cover for inflation, the rise of prices for products and services. One dollar has less purchasing power now than it did years ago because of inflation. That’s why it’s important to invest.

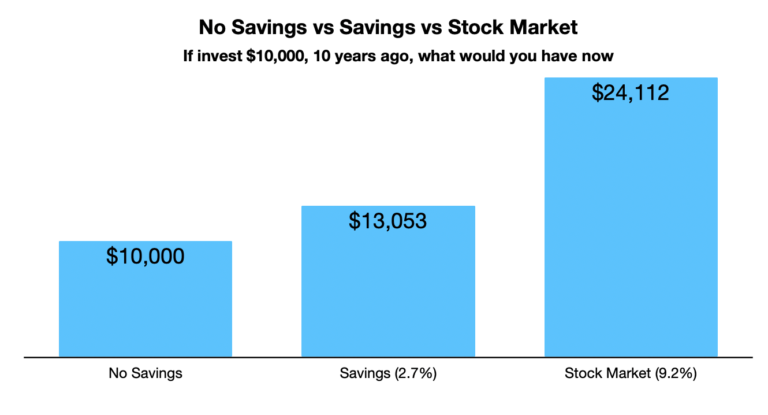

The chart below is an example of investing $10,000 over 10 years ago. This chart is just for illustration purposes.

Chart Data: According to DepositAccounts, a 5-year CD interest rate in 2010 was 2.7%, and according to Goldman Sachs data cited by Business Insider, the average 10-year stock market return is 9.2%.

This chart shows the reason why you should invest. When should you start investing? As soon as possible. As the saying goes, don’t try and time the market. It’s your time in the market.

Before You Start Investing

Below is a quick chart of five questions to ask yourself before you start investing.

1) Purpose of Investing

Ask yourself why are your investing? Are you investing for retirement, or non-retirement to grow wealth, tuition for your child, downpayment for future home purchase, etc?

2) Risk Willing to Take

Ask yourself what you want to invest in? What you invest in is determined on level of risk you are willing to take on your investments (low to high risk). Some investments are more volatile than others.

3) Timeframe of Using Funds

Ask yourself when you plan on using these funds (investments)? This can determine how liquid and available your investments are, or are you willing to lock up your investments in a CD for a period of time (1,2, or 3 years), or do you need it in the short term.

4) Goal Dollar Amount

Ask yourself how much are you willing to initially invest and what’s the investment goal you want to reach? Some investments require a minimum initial investment amount. Depending on your timeframe of when you need to reach a goal of a certain dollar amount, this may determine the amount of risk you’re willing to take.

5) Manage Own Portfolio or Not

Ask yourself how involved do you want to be in your investing? Do you want to be hands on and manage your investment, have an investment broker, or a robo advisor?

How to Start Investing

1) 401(k) with Company Work For

If you are working, majority of companies offer a 401(k), and they also have a company match. This is a good way to start investing if you are working and you can take advantage of matching contributions. 401(k) is a retirement account and can only be accessed at retirement age or with certain exceptions. Ask your Human Resources department about investing in a 401(k) and what’s the company match. I do want to give one word of advice. If you have been employed at various jobs and opened a 401(k), make sure you consolidate your 401(k) accounts by rolling it over to your current employer 401(k), or better yet, open a separate IRA account. It becomes difficult to keep track of your 401(k) investments when it’s still with your previous employer(s).

2) Open Brokerage Account

If you have a high risk tolerance and you want to be hands on with your investing, you can open a brokerage account and invest in individual stocks, which has no fees or commissions to purchase stock. There are many brokerage accounts to choose from such as TD Ameritrade, E*Trade, Robinhood, etc. Find the one that’s best for you.

3) Mutual Funds

You can also invest in mutual funds which are a pool of investors that have a portfolio investment manager to maintain a diversity of securities. However, there are fees or expenses charged for the management of the fund.

4) Index Funds

You can invest in an index fund, such as S&P 500 Index Fund which will track to the S&P 500. The S&P 500 is a good gauge of the U.S. large-cap equities market. It’s composed of the top 500 U.S. companies listed in the major stock exchanges based on their market capitalization. You can look at what the top S&P index funds are such as Vanguard, Fidelity, Invesco, iShares. They also have fees or expenses but they can be lower fees than mutual funds.

5) CDs

If you have a low risk tolerance, you can invest in CDs which will have a very low interest rate and most likely will not offset inflation. CDs will give you a better interest rate than online savings account but you agree not to touch the money for a specific period of time.

For me personally, I choose to invest in individual stocks. This is a personal decision and dependent on your current financial situation, your risk tolerance and if you want to manage your own investments. For me, investing has always been fun, especially when you see your wealth grow.

Learned Through Investing

I want to share what I have learned through investing and what I have learned from others. Please note, I am not a financial advisor, and the investing information is for educational purposes and not stock investment advice.

1) Investing in Individual Stocks Requires Research and Time.

Always take time to learn and educate yourself about investing. That means reading and watching business news, and following the stocks you have purchased and what’s impact it.

2) You can choose to diversify your stock holdings or not.

Or you can focus on investing in companies you truly believe in and will continue to grow and be innovative. Continue to grow the amount of shares you own in these stocks when the market dips. A company that is not innovative, will not survive changes in the future. Case in point is the 2020 pandemic, where many places were locked down. If a company or service didn’t have the infrastructure or system in place for online ordering/services and delivery, or was not quick to make changes, they probably didn’t survive the shut down.

3) Do not get attached to a stock.

When you buy a stock and the stock has reached your investment goal, then sell. You cannot be sentimental with a stock. For me, there are stocks that are short term versus long term investments. There are some stocks I believe will grow over the long term and I will hold on to those stocks for now. But there are some stocks that are short term which I believed was a good purchase, and my plan was to sell when it reached my investment goal. That profit I can then use to fund my long term stock purchases.

4) Do not time the market, but it’s time in the market.

People ask, when is a good time to invest? Just get in and invest. Once you have done your research on a stock, then it’s time to invest. You will buy that stock over time. When the market dips, purchase more of the stock. The market will always fluctuate.

5) There are tax Implications.

Yes you do get taxed on stocks, and dividends earned. I would suggest talking to your tax professional regarding the tax implications. It can be considered ordinary income or capital gains tax depending on how long you have held on to the stock before selling it.

6) Do not invest money you need right away.

This is an important rule. If you do not have a savings account with money for unexpected things like car or home repair, large medical expense, or if you are laid off, then you should have this first. Rule of thumb is to have about 3-6 months of living expenses saved. The money you invest in the stock market can make you double, triple and more than the amount you invested. But you also can lose money as when the market crashed with the lock down in 2020.

The key is to start investing as soon as possible. Start with $100. Your investments will grow over time and you will be surprised at the number of shares you will own.

If you are having problems with your budget, and money is managing you and you are not managing money, click on the action button to find out about programs offered to assist for financial success.